Energy, Power & Infrastructure

Industrial Services & Manufacturing

Environmental & Sustainability

Mergers & Acquisitions

CIMA Services is a full-service industrial and environmental resources company specializing in civil, structural, mechanical and waste management services for companies operating in the petrochemical, refining, midstream oil and gas, and general industrial industries across the U.S. Gulf Coast region. Headquartered in Pasadena, Texas, CIMA’s strategic location near the Houston Ship Channel facilitates rapid responsiveness and mobilization of personnel and equipment. The Company is led by a team of seasoned industry veterans and supported by more than 400 employees, including a broad array of skilled tradesmen.

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1942, Basler is a third-generation, family-owned manufacturer of electrical control and protection solutions, based in Highland, Illinois, with approximately 700 employees. Basler’s innovative products regulate and protect mission-critical equipment and are used by more than 1,600 global customers across a diverse range of critical applications and high-growth end markets, including power generation, power transmission, grid and utility infrastructure, HVAC, data centers, and industrial and electrical equipment. The Company operates three manufacturing facilities in Highland, Illinois; Taylor, Texas; and Piedras Negras, Mexico.

Business Services

Mergers & Acquisitions

For over 50 years, Steger Bizzell has been a leader in civil engineering in Central Texas. The Company has performed more than 22,000 projects for governmental and private clients, with expertise covering a wide range of disciplines including hydraulic and hydro-logic analysis, floodplain mapping, transportation, water and wastewater utilities, planning and site design, and surveying. Headquartered in Georgetown, just north of Austin, Steger Bizzell adds a team of more than 50 technical experts with deep water, wastewater and land development expertise to CHA, a full-service engineering, design, and management consulting firm. Steger Bizzell will rebrand as Steger Bizzell, A CHA Company. The acquisition expands CHA’s team to more than 2,100 professionals across 55+ offices, from Canada to Florida to California.

Consumer Products & Services

Mergers & Acquisitions

Alpha, a privately held, family-owned frozen foods manufacturer based in Waller, Texas, was founded in 1984 by Greek immigrants George and Athena Sarandos. Alpha has grown from a regional foodservice distributor into a highly respected producer of frozen pizzas and pizza components for national accounts. Today, Alpha operates from a modern, highly efficient, 115,000-square-foot manufacturing and distribution facility serving a broad range of customers, including K-12 schools, leading grocery retailers and well recognized packaged foods brands.

Industrial Services & Manufacturing

Business Services

Mergers & Acquisitions

For nearly 40 years, Fencecrete has been a leading provider of custom precast concrete fencing and wall systems, offering durable, low-maintenance and environmentally friendly products. The Company’s steel-reinforced designs are available in a wide variety of integrated colors and styles that imitate the look of wood, brick, stucco and stone, among others. Fencecrete’s versatile systems are used for perimeter and security walls, property dividers, storage screens, waste enclosures, parking lot fences, and noise, fire and wind barriers. Fencecrete delivers its high-quality, long-lasting solutions to commercial and residential developers, architects and property owners from three locations across Texas, with the ability to serve customers nationwide.

JHBDMB Holdings, Inc.

Industrial Services & Manufacturing

Based in Houston, BWFS is a full-service, ASME-certified fabricator of large, complex pressure vessels with in-house capabilities to engineer, draft, fabricate, stress relieve, sandblast, and coat large pressure vessels in one location with minimal outsourcing. The Company has proudly served the offshore oil and gas industry for more than 25 years and has over 14,000 vessels in use around the world.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1925 as Arthur Dooley & Son and renamed Dooley Tackaberry following its 1987 acquisition of The Tackaberry Company, Dooley has an extensive history in the distribution of fire and safety equipment to the oil and gas industry and municipal fire service market. Having grown steadily, Dooley’s biggest strengths are designing and fabricating fire detection and suppression systems as well as supplying fire protection and personal protective equipment to upstream, midstream and downstream customers throughout the world. Today, Dooley represents all major product lines in the fire and safety equipment industry.

Energy, Power & Infrastructure

Mergers & Acquisitions

Adams is engaged in crude oil marketing, transportation, terminalling and storage tank truck transportation of liquid chemicals and dry bulk and recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, GulfMark Energy, Inc., Service Transport Company, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC, Phoenix Oil, Inc., and Firebird Bulk Carriers, Inc. The Company was previously listed on the American Stock Exchange under the symbol “AE.”

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1982 by Bob Allen and led by Chris Sellers and Mike Hill, AHI is a leading manufacturer and distributor of quality masonry and related construction products for the Texas market, selling both directly to customers and through third-party building products distributors. The Company is headquartered in Alvin, Texas with additional locations in the Austin and Dallas-Fort Worth markets. AHI manufactures a variety of proprietary products, including Portland and masonry cements, brick cleaners, stucco coatings and cast stone, as well as performing a wide array of structural iron processing services. Manufactured products are sold under the Spectrum and Tex-Clean brands. AHI Supply serves single-family residential, multi-family residential and commercial markets.

Industrial Services & Manufacturing

Mergers & Acquisitions

Located in Port Arthur, Texas, PAT Tank is a leading turnkey provider of construction and repair of above-ground liquid storage tanks (“ASTs”) to a variety of industrial end markets across the United States. The company’s capabilities include tank design, fabrication, delivery, installation and coating services, as well as distribution and installation of related products. PAT Tank is strategically positioned in the heart of the United States Gulf Coast region with ready access to the most highly concentrated installed base of hydrocarbon ASTs in the country. Its services are in consistent demand due to the ongoing operating and regulatory requirements that drive regular tank installation, repair and upgrade.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1999 and headquartered in Collinsville, Oklahoma, Victory is a leading designer and manufacturer of industrial and commercial combustion, heat-transfer and steam production solutions, ranging from engineered firetube and watertube boilers and burners to heat recovery steam generators and high temperature hot water heaters. As part of the Company’s customer commitment, Victory provides extensive aftermarket customer support services, such as installation, commissioning and maintenance services, spare parts, burner and economizer retrofits and boiler fleet rental. Victory operates globally across a diverse and extensive group of industry sectors, including chemical, pulp & paper, food & beverage, bio-renewables, agriculture, education, healthcare, aviation and utilities.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1973, Texas Tool Traders is a leading retailer of fasteners, tools and other supplies serving the single and multi-family residential construction market across Texas. The company is headquartered in Weimar, Texas and operates 14 locations statewide, supporting customers in the Austin, Dallas-Fort Worth, San Antonio and Houston metro areas. The Company sells to homebuilders, contractors, roofers, fencers, pallet companies, homeowners and more.

Industrial Services & Manufacturing

Environmental & Sustainability

Mergers & Acquisitions

Based in North Carolina, Wall Recycling is a premier provider of integrated waste and recycling solutions. With a commitment to sustainability and innovation, Wall Recycling provides full-service waste management for both commercial and consumer customers. This divestiture allows Wall Recycling to strategically focus on its core integrated waste operations. The Company plans to make additional acquisitions, looking to build upon its strong waste platform while maintaining its leadership in the North Carolina market.

Industrial Services & Manufacturing

Environmental & Sustainability

Business Services

Software & Tech-Enabled Services

Mergers & Acquisitions

Divcon Controls provides building automation consultation and custom design for the commercial and manufacturing industries.

Specialty Distribution

Mergers & Acquisitions

Texcel is a leading branded supplier of premium quality industrial and hydraulic hoses and fittings, fluid sealing products and related services. With over 40 years of commercial operations, Texcel has established a clear leadership position in the fluid conveyance market through significant, long-term investments in product development, platform infrastructure and exceptional customer service. Headquartered in Houston, Texcel has established a strong national footprint, serving top-tier independent distributors across the country out of facilities located in Texas, Illinois, Delaware, Alabama and Colorado.

Specialty Distribution

Mergers & Acquisitions

Founded in 1997 by David Rollen and headquartered in Coppell, Texas, Rock Materials is a wholesale distributor of natural and architectural cut stone, manufactured stone, cast stone and masonry supplies. Rock Materials also operates at a second location in Tomball, Texas, a suburb of Houston. Rock Materials is the largest provider of architectural stone within the state of Texas and the transaction marks a substantial expansion in this line of business for SRS. The Company’s senior management team will continue in their functions, leading this effort while retaining upside opportunity as shareholders in SRS post-closing.

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 2008, PurgeRite is the leading provider of mechanical flushing and filtration services for water-based HVAC and geothermal systems. The Company ensures these systems operate with maximum efficiency and reliability across a variety of critical environments, including data centers, semiconductor fabrication, K-12 schools, universities, medical centers and other advanced manufacturing operations. Clean, efficient systems reduce power and water usage, ongoing maintenance and downtime, delivering meaningful savings and peace of mind to facility owners and operators.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Environmental & Sustainability

Mergers & Acquisitions

Founded in 1985 and based in Deer Park, Texas, Miller Integrated Solutions is a leading industrial cleaning, environmental, and mechanical services company that operates within the downstream, midstream, and upstream hydrocarbon processing markets. With six strategically located facilities across its Gulf Coast footprint, Miller Integrated Solutions leverages its 400+ field-based crewmembers to support over 100 master service agreements across multiple recurring, maintenance-driven, service disciplines including tank cleaning, unmanned hydroblasting, vacuum truck services, spill cleanup, air mover & hydro excavation, chemical cleaning, vapor control, rubber lining & coating services, field specialty welding, mechanical maintenance and fabrication. The Company also has extensive experience in the environmental spill response industry and can build, clean and demolish equipment and structures, as well as support any environmental needs throughout the lifecycle of its customers.

Industrial Services & Manufacturing

Business Services

Mergers & Acquisitions

Founded in 2009 and based in Reno, Nevada, NDSS is the largest installer of drywall, stucco and stone materials for contractors serving the multifamily residential, commercial and housing markets in western Nevada and eastern California. The principals of NDSS will retain equity positions in the business and will continue in their leadership roles.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Based in Odessa, Texas, and established in 2003, eTech is a leading environmental remediation business providing regulatory mandated environmental consulting, soil sampling & testing, remediation, waste management, and long-term compliance services to a large base of blue-chip customers in the upstream, midstream, government, and industrial end markets throughout the Permian Basin. With over 125 skilled environmental technicians and professionals in the field, a top-tier safety record, and a robust portfolio of Master Service Agreements, the Company’s services allow them to work in a diverse array of environmental disciplines, including soil and groundwater testing, remediation, asbestos, mold and lead consulting, federal and state permitting assistance, and a broad range of compliance support. The partnership with KLH will enable the Company to accelerate its growth and continue to expand its service offerings throughout the United States.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

Headquartered in Houston, Texas and founded over 35 years ago, ZymeFlow is the worldwide leader in decontamination of hydrocarbon process equipment for entry, inspection, maintenance and effluent management. The proprietary ZymeFlow process prepares equipment for entry by simultaneously de-oiling while eliminating pyrophoric iron sulfide, hydrogen sulfide, benzene and other explosive gases. ZymeFlow products and services are currently utilized in refining, petrochemical, and LNG facilities for both onshore and offshore customers in more than 55 countries. ZymeFlow’s ecofriendly and patented products and services are highly efficient in the decontamination and maintenance of energy and chemical processing facilities in the United States and around the world.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1997, FCI is a vertically integrated provider of high-quality forged, heat treated, and machined pressure control connection products for the downstream, midstream, upstream, LNG, marine, aerospace, and defense markets. FCI’s product portfolio along with its forging and heat treat capability are highly complementary to Westbrook’s current offerings and will allow the combined platform to better serve a wider range of customers.

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

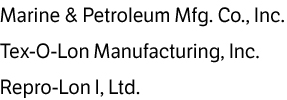

Headquartered in Texas City, Texas, Farmers Copper is a leading metal supply company. It is a legacy business descended from Farmers Marine Copper, a company that was founded in Galveston, Texas in 1920 by Les and Sidney Farmer. Farmers Copper supplies copper, brass and bronze alloys to a long-standing customer base across aerospace, marine, defense, oil & gas and electrical market segments in North America. The Company distinguishes itself with its excellent service, custom processing capabilities and outstanding delivery performance. The Company will be integrated into the industry-leading service center network of Wieland Metal Services, a business unit of Wieland.

Industrial Services & Manufacturing

Environmental & Sustainability

Mergers & Acquisitions

Raising Capital

Cross-Border Transactions

Headquartered in Clackamas, Oregon, PNW operates a full-service ferrous and non-ferrous metal recycling business. The Company sells its recycled metal product to both international and domestic markets. PNW gathers scrap in North America and sells hundreds of thousands of tons of recycled metals to hundreds of domestic and international customers per year. PNW’s services are key to a growing circular economy, offering a low-cost replacement to virgin metal production. Recycled steel scrap saves approximately 70% of energy (95% for aluminum) and 55% of CO2 emissions when compared to virgin materials, according to the World Steel Association.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Through its subsidiaries, Matrix is a leading North American industrial engineering, construction, and maintenance contractor headquartered in Tulsa, Oklahoma with offices located throughout the United States and Canada, as well as Sydney, Australia and Seoul, South Korea. The Company provides services in three key operating segments: utility and power infrastructure, process and industrial facilities, and storage and terminal solutions.

Industrial Services & Manufacturing

Mergers & Acquisitions

Displayit builds custom environments from design to engineering to manufacturing to installation. Displayit takes the look and feel of the Company’s brand and build booths, kiosks, in-store fixtures and interiors around that image.

Consumer Products & Services

Mergers & Acquisitions

Founded in 1982, Brenham-based Del Sol Food is a family-owned and operated manufacturer of BRIANNAS Fine Salad Dressings, the leading premium salad dressing brand in the category. BRIANNAS is produced in small batches with high quality ingredients, and their products are sold in all 50 states and distributed worldwide to over 10 different countries.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 2008 and based in Alvin, Texas, Mat Tech has a complementary rental and transportation fleet that offers customers along the Gulf Coast mission critical products and services in support of maintaining, repairing and constructing industrial assets. The Company maintains a large and diverse inventory of mats, skids, pads, liquid containment tanks, portable toilets and other products. Mat Tech also transports and disposes of liquids and chemicals.

Business Services

Mergers & Acquisitions

Founded in 1976, Champions Hydro-Lawn is the leading commercial erosion control and turf establishment specialist in the greater-Houston market. The Company offers a full range of services including: mowing, handwork, overseeding, fertilization, irrigation, rehabilitation, storm water pipe replacement and other essential services for Municipal Utility Districts, commercial developers, HOAs, and other commercial clients.

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

Located in Houston, Texas, Enduro is a global leader in the design and manufacture of non-metallic composite products and solutions that deliver value to its customers. With a history of innovation and industry firsts, its fiber reinforced polymer (FRP) solutions have earned worldwide respect and recognition in many of its businesses, including TUFF SPAN™ building products, electrical cable management, water and wastewater structures, field services and custom FRP manufacturing. Employing diverse, manufacturing capabilities, Enduro provides lasting solutions for challenging conditions in industrial and infrastructure market segments like chemical processing, mining, water, wastewater, metal processing, fertilizer, power, pulp & paper, oil & gas, offshore and marine, food processing and mass transit.

Industrial Services & Manufacturing

Mergers & Acquisitions

For over 50 years, Powertherm Maxim has provided air intake and exhaust system accessories for large reciprocating engines. The Company’s silencers and catalytic converters abate sound and reduce emissions in the gas compression, power generation, energy infrastructure, marine, and industrial markets. Powertherm Maxim is headquartered in Houston, Texas with branch offices in Odessa and Fort Worth, Texas and El Reno, Oklahoma.

Consumer Products & Services

Mergers & Acquisitions

Founded in 1971 by Heida Thurlow, Chantal is the first woman-owned cookware business in the United States. For over 51 years, Chantal has designed premium kitchenware products that are sold nationally and internationally through multiple retail channels. The Company has become the most renowned name in enamel-on-steel cookware, specializing in teakettles, cooking and kitchen products, and assorted ceramics. Chantal was the first to bring dramatic color, tempered glass lids, stay-cool handles, and environmentally friendly cookware for cooking, serving and storing to the world’s market. The Company has received numerous design and utility patents for its innovative products, including one for the introduction of the innovative Hohner harmonica whistle.

Industrial Services & Manufacturing

Specialty Distribution

Mergers & Acquisitions

Cross-Border Transactions

Based in Billings, Aspen Air is a leading manufacturer and distributor of bulk liquid industrial gases in Montana and the surrounding states. Aspen Air supports a diverse industrial and medical base of customers including those in the energy and chemicals sectors, hospitals, and the very important packaged gases and independent distributor network.

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 2011 and based in Houston, Momentum provides exterior and interior glass and glazing solutions to the Texas region. Momentum delivers a complete line of design, manufacture and install services to meet the most demanding exterior and interior applications for commercial building projects in education, healthcare, municipal, office, multi-family and airport end markets.

Industrial Services & Manufacturing

Environmental & Sustainability

Mergers & Acquisitions

Since 1979, C&D has been the Greater Houston Area’s premier scrap metal recycler. Led by Co-Founders Cindy and Dennis Laviage, C&D has become a household name across Houston given the team’s emphasis on and successful execution of its retail advertising campaigns. The Laviages built unrivaled brand recognition via near-constant television and radio commercials, establishing the now ubiquitous “We Pay You in $2 Bills!” trademark which generated over 14.6 million television and 15.0 million radio impressions in 2021 alone.

KSA Industries, Inc.

Energy, Power & Infrastructure

Advisory Services

Adams is engaged in the marketing, transportation, and storage of crude oil through its subsidiaries GulfMark Energy, Inc, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC; the transportation of liquid chemicals and dry bulk through its subsidiary Service Transport Company; and the recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, Phoenix Oil, Inc. and Firebird Bulk Carriers, Inc. The Company is listed on the American Stock Exchange under the symbol “AE.”

Energy, Power & Infrastructure

Raising Capital

Adams is engaged in crude oil marketing, transportation, terminalling and storage tank truck transportation of liquid chemicals and dry bulk and recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, GulfMark Energy, Inc., Service Transport Company, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC, Phoenix Oil, Inc., and Firebird Bulk Carriers, Inc. The Company is listed on the American Stock Exchange under the symbol “AE.”

Financial Advisory Services

Energy, Power & Infrastructure

Advisory Services

Adams is engaged in the marketing, transportation, and storage of crude oil through its subsidiaries GulfMark Energy, Inc, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC; the transportation of liquid chemicals and dry bulk through its subsidiary Service Transport Company; and the recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, Phoenix Oil, Inc. and Firebird Bulk Carriers, Inc. The Company is listed on the American Stock Exchange under the symbol “AE.”

Financial Advisory Services

Energy, Power & Infrastructure

Advisory Services

Adams is engaged in the marketing, transportation, and storage of crude oil through its subsidiaries GulfMark Energy, Inc, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC; the transportation of liquid chemicals and dry bulk through its subsidiary Service Transport Company; and the recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, Phoenix Oil, Inc. and Firebird Bulk Carriers, Inc. The Company is listed on the American Stock Exchange under the symbol “AE.”

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Thorpe Specialty Services is a leading specialty services provider in energy and industrial markets for maintenance and engineering for corrosion, refractory and scaffolding and insulation. Clients turn to Thorpe for reoccurring specialty services related to the maintenance of critical infrastructure assets operating in high-temperature and highly corrosive environments. From Fortune 500 companies to independent producers and EPC’s across oil & gas, chemical, power, pulp & paper, mining and other energy-intensive industries, Thorpe is a trusted partner for extending equipment lifecycles and increasing productivity for refineries, chemical, petrochemical and industrial plants.

Business Services

Mergers & Acquisitions

Established in 2010, Boa Logistics is a service-focused freight management company, utilizing technology to stay ahead of the competition. Boa specializes in refrigerated LTL freight movements and consolidation nationwide. Additionally, Boa also operates a cold-storage facility to serve its customers (Flow Cold Storage). Boa focuses on mission-critical movements of perishable temperature-controlled freight for medium-sized companies, with destinations including big-box retail, grocery, and restaurant distribution. Additionally, Boa handles dry freight and drayage-related movements and consolidations for customers.

Consumer Products & Services

Mergers & Acquisitions

Founded in Austin, Texas in 2001 by Rob Jones and Tim League, Mondo is an ecommerce enterprise that creates some of the world’s most sought-after collectibles. Mondo’s unique screen-printed fine-art posters, collectible figures and vinyl records regularly sell out online. Mondo collaborates with world-class artists to design and put their own spin on classic and contemporary film, music, video games, toys, apparel, books, television properties and other collectibles.

Consumer Products & Services

Mergers & Acquisitions

Fiesta Canning is one of the largest family-owned green chile processing plants in the United States. Located in the rural town of McNeal, Arizona, the Company started as a family farming venture more than 70 years ago and evolved into a high-volume producer of high-quality southwestern food products that include sauces, salsas and other fresh pack items. Fiesta Canning has a strong presence across commercial channels, serving as a trusted manufacturing partner for leading national brands, high-volume foodservice distributors, retail private label customers and its owned brands.

Permico Founders, LLC

Energy, Power & Infrastructure

Mergers & Acquisitions

Financial Restructuring

Permico Midstream is a development-stage midstream oil and gas company based in Houston, Texas. The Company is focused upon developing, constructing, and operating assets to transport and process natural gas liquids in Texas, as well as the domestic and international marketing of the end products.

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

The 600 Group (ASE: SIXH.L) is a diversified engineering group with a world class reputation in the manufacture and distribution of machine tools, precision engineered components and laser industrial systems. The Company is headquartered in the United Kingdom and operates from locations in North America, Europe and Australia, selling into more than 100 countries worldwide. The Machine Tool Solutions Division has a strong reputation in the market for metal turning machines with products ranging from small conventional machines for education markets, CNC workshop machines and CNC production machines.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

Plasson USA is a full line manufacturer of high-density polyethylene (HDPE) pressure pipe fittings from ½” to 65″ diameter and pressures up to 320 pound-force per square inch, and lower-pressure HDPE pipe up to 120″ in diameter under its Spirolite™ brand. The Company’s customers are distributors to industry, municipalities and commercial enterprises across North America. Following the acquisition, former parent company Plasson Ltd. will retain its core business distributing HDPE Electrofusion products throughout North America.

Industrial Services & Manufacturing

Mergers & Acquisitions

Metal-Matic is a global leader in the production of welded and drawn over mandrel carbon steel tubing for standard and specialty applications. The transaction included Metal-Matic’s four production facilities, which employ over 500 associates in Minnesota, Illinois and Ohio.

Consumer Products & Services

Raising Capital

Blue Link Wireless is AT&T’s second largest National Authorized Retailer with a combined footprint that extends to 231 locations across 21 states.

Consumer Products & Services

Mergers & Acquisitions

Buy-Side Advisory

Blue Link Wireless is AT&T’s second largest National Authorized Retailer with a combined footprint that extends to 231 locations across 21 states.

Specialty Distribution

Mergers & Acquisitions

Consumer Products & Services

Raising Capital

CE Workforce is a leading T-Mobile Preferred Retailer with operations in five states across the southeastern U.S.

Consumer Products & Services

Mergers & Acquisitions

Wireless World is a leading T-Mobile Preferred Retailer with operations in seven states across the U.S.

Energy, Power & Infrastructure

Business Services

Mergers & Acquisitions

Founded in 1988 and based in Houston, Texas, Power Plumbing is the largest plumbing-focused mechanical contractor serving multi-family builders throughout Texas. The Company has delivered best in class results, service, and value to customers for over 30 years while utilizing the latest technologies and offering a full range of capabilities that span the entire construction process.

Industrial Services & Manufacturing

Mergers & Acquisitions

Based in Houston, Texas, McDaniel Metals has been a leading manufacturer of innovative, aftermarket HVAC components since 1982. The Company designs and fabricates primarily aftermarket components for the residential and commercial markets including curbs, curb adaptors, filter bases, economizers, dampers and other accessories, many of which improve indoor air quality and energy efficiency.

Consumer Products & Services

Mergers & Acquisitions

Web Deals Direct is amongst the largest global FBA sellers on Amazon with an owned-brand portfolio spanning several everyday use categories, including Home & Kitchen, Patio & Garden, Sports & Outdoors, Arts & Crafts, Pet Supplies and Office Products. The Company utilizes a sophisticated analytics platform that provides real-time visibility into all aspects of the business, from the production supply chain to a myriad of critical marketplace decision points. Extraordinary execution in high volume product identification, compelling branding, exceptional customer service and dynamic selling platform management, have afforded Web Deals Direct a massive base of 4+ star consumer reviews and a demonstrable leadership position in the FBA seller universe.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Founded in 1986 and headquartered in Baytown, Texas, EMSI is a leading environmental services company providing emissions leak detection and repair services. The Company designs and administers programs necessary for client compliance with a complex array of federal, state and local environmental regulations. EMSI employs more than 300 technicians within some of the largest refineries, petrochemical, natural gas processing, oil and gas pipeline, and specialty chemical plants in the United States. It serves more than 150 facilities in 38 states across the nation, with a leading presence in the Gulf Coast region.

Consumer Products & Services

Raising Capital

Blue Link Wireless is AT&T’s second largest National Authorized Retailer with a combined footprint that extends to 231 locations across 21 states.

Consumer Products & Services

Mergers & Acquisitions

Based in Cincinnati, Ohio, Easy Way is a specialized manufacturer of premium outdoor furniture products, providing full-service design and production services to luxury Home Décor retailers across North America. Easy Way’s unique operational configuration enables its retail partners to offer mass customization of fabric choices and rapid fulfillment to the end consumer, while benefitting from extremely short lead-times and significant improvements in inventory efficiency.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

Buy-Side Advisory

Bright is the dominant North American formulator and contract manufacturer of hair bleach and depilatory powders for leading global beauty brands, with a long-standing reputation for product quality, consistency and extraordinary customer service levels. Founded in 1989 and based in Santa Clarita, California, Bocchi is a high volume, liquids manufacturer of personal care products utilized in the hair care, skin & body care, and personal fragrance end markets.

Energy, Power & Infrastructure

Mergers & Acquisitions

Action Scaffold was founded in 1953 and operates as a leading provider of scaffolding rental equipment and services in its Southwest market. The Company brings industry leading experience on scaffolding products and safety, which has defined them as a top scaffold rental and erection business over the last 70 years. The Company understands the demands that scaffold dealers and contractors face, and accordingly provides its customers with quality products and services to meet stringent market requirements. Since 1953, Action Scaffold has built strong, long-lasting relationships in its region amongst industrial and commercial end users. As one of the founding members of the Scaffold & Access Industry Association, Action Scaffold continues to be a leader in the scaffold industry.

Energy, Power & Infrastructure

Mergers & Acquisitions

Founded in 1934 and headquartered in Houston, Texas, Griffin operates out of 11 locations across the country and is a leading provider of groundwater control solutions for large scale civil and infrastructure, industrial, power and commercial construction projects. With a legacy built around complex dewatering services, Griffin offers unique design, engineering, permitting and system installation capabilities with an extensive fleet of specialized pump equipment. Additionally, the Company provides a complete water management solution for its customers with its services, including highly technical water treatment system design, installation and management.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Based in New York and Texas, Flow Safe manufactures high quality and high-performance over-pressure protection solutions. Flow Safe’s experienced engineering and application staff are constantly developing unique and advanced OPP solutions for natural gas transmission and distribution, petroleum, chemical, power, food and beverage, marine and aerospace industries.

Industrial Services & Manufacturing

Mergers & Acquisitions

Quest specializes in designing, fabricating and installing premium millwork and case goods for a variety of commercial uses, including builders’ sales centers, design studios, hospitality, corporate offices and healthcare. Based near Houston, Texas, Quest had approximately $22 million in sales in 2019. Jon Deutser, president and CEO of Quest, will continue to run the company.

Industrial Services & Manufacturing

Business Services

Mergers & Acquisitions

Founded in 2002, JohnSon Fence is the largest designer and installer of decorative and functional residential fencing in the southeast Texas market. Founders John and Eric Dale, a father and son team, recognized the opportunity to professionalize a highly fragmented and poorly managed segment of the homebuilding industry. JohnSon Fence is one of the few companies capable of providing most types of fencing and gates, including wood picket, decorative wood, masonry (brick, stone), iron and ranch style. The Company’s customer base primarily comprises major homebuilders and residential developers. JohnSon Fence has grown its business by gradually building and leveraging a reputation for reliability by providing quality work and timely delivery that are unparalleled in the industry. The Company serves a large and growing list of communities in the region from its facility in Tomball, Texas.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

TriStar Global Energy Solutions, one of the leading hydrocarbon cleaning and decontamination companies in the U.S., elected to divest two subsidiaries: TriStar PetroServ and Global Vapor Control (collectively referred to as TriStar Tank Services). TTS provides specialized services focused on technical tank cleaning and degassing in refineries and midstream facilities in the Gulf Coast and throughout the United States.

Energy, Power & Infrastructure

Raising Capital

Manufacturers and sellers of disposable setting tools, power charges, and igniters used in the completion of oil and gas wells.

EZ Innovations Ltd

Consumer Products & Services

Mergers & Acquisitions

Buy-Side Advisory

Web Deals Direct is amongst the largest global FBA sellers on Amazon with an owned-brand portfolio spanning several everyday use categories, including Home & Kitchen, Patio & Garden, Sports & Outdoors, Arts & Crafts, Pet Supplies and Office Products. The Company utilizes a sophisticated analytics platform that provides real-time visibility into all aspects of the business, from the production supply chain to a myriad of critical marketplace decision points. Extraordinary execution in high volume product identification, compelling branding, exceptional customer service and dynamic selling platform management, have afforded Web Deals Direct a massive base of 4+ star consumer reviews and a demonstrable leadership position in the FBA seller universe.

Consumer Products & Services

Raising Capital

Web Deals Direct is amongst the largest global FBA sellers on Amazon with an owned-brand portfolio spanning several everyday use categories, including Home & Kitchen, Patio & Garden, Sports & Outdoors, Arts & Crafts, Pet Supplies and Office Products. The Company utilizes a sophisticated analytics platform that provides real-time visibility into all aspects of the business, from the production supply chain to a myriad of critical marketplace decision points. Extraordinary execution in high volume product identification, compelling branding, exceptional customer service and dynamic selling platform management, have afforded Web Deals Direct a massive base of 4+ star consumer reviews and a demonstrable leadership position in the FBA seller universe.

Consumer Products & Services

Specialty Distribution

Mergers & Acquisitions

Founded in 2011 and headquartered in Belding, Michigan, Flat River is a value-added distributor of consumer products with full-service warehousing and fulfillment capabilities for the North American markets. The Company’s deep knowledge of the eCommerce retail ecosystem, vast product assortment and proven drop-ship capabilities provide both its suppliers and its eCommerce customers with a turn-key solution to drive sales through product identification, dimensional inventory management and industry-best fulfillment execution.

Consumer Products & Services

Mergers & Acquisitions

Founded in 1990 and based in Cranford, New Jersey, National Tree Company is the recognized leader in the design, procurement, sale distribution and fulfillment of seasonal décor products, specializing in the Christmas Holiday. Products include lifelike trees, wreaths, garlands, shrubbery and decorative accessories. National Tree’s customer base includes the largest e-Commerce and brick and mortar retailers in the United States and Canada. With five dedicated facilities, and a growing 3PL network across North America, National Tree is far and away the scaled industry leader, with volume fulfillment capabilities that enable massive assortment expansion and inventory efficiencies for its customers.

Business Services

Software & Tech-Enabled Services

Mergers & Acquisitions

Headquartered in Houston, Texas, JMFA provides software and tech-enabled services designed to optimize overdraft programs for regional/community banks and credit unions. The Company serves more than 350 customers with its core overdraft privilege program. JMFA also provides vendor contract negotiation services and uses proprietary software and ongoing consulting to confirm compliance and identify areas of improvement with client overdraft programs.

$4,000,000

Environmental & Sustainability

Business Services

Healthcare

Raising Capital

Paragon Southwest Medical Waste (PSMW), which completed its second round of financing in November 2019, utilizes its patented CoronaLux™ technology to thermally destroy certain types of medical waste. This new financing will increase the capacity of PSMW’s facility in Anahuac, Texas by over 100%, allowing the Company to meet the high demand for its services. The CoronaLux™ system employs a low-energy, plasma-enhanced, pyrolytic process to safely and reliably destroy hazardous, chemical, biological, pharmaceutical and regulated medical waste. It also significantly reduces harmful emissions associated with high-temperature thermal processes such as incineration and conventional hot plasma incineration. The result is a more efficient and sustainable destruction process, which is much cleaner, safer and environmentally friendly.

Energy, Power & Infrastructure

Mergers & Acquisitions

Cross-Border Transactions

W&W is a leading provider of production infrastructure-related services to oil and gas producers operating in the Permian Basin. The Company operates through two primary divisions: (1) Maintenance, Repair and Overhaul (“MRO”) services, and (2) Pipeline Installation and Maintenance. W&W’s MRO division provides in-the-field, routine maintenance, monitoring, and inspection of production-related equipment, well-sites and pipelines that is required throughout the entire life cycle of a well. Additionally, W&W’s MRO division provides production facility construction, including the installation of tank batteries and compressor stations as well as their routine upgrades and expansions. The Company’s Pipeline division installs small diameter flexible and polyethylene pipelines, primarily for oil and gas gathering projects, well hookups and water transportation. Additionally, the Pipeline division provides ongoing retrofitting and maintenance services. W&W is headquartered in Odessa, Texas with additional facilities in Midland, TX, Monahans, TX and Carlsbad, NM.

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

Founded more than 25 years ago, International Assembly, Inc. is a leading value-added, asset-light manufacturing services business with impressively consistent growth over its operating history. The Company is headquartered in Texas and conducts its manufacturing services operations through subsidiaries located in Mexico.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Tanknology is the largest provider of environmental compliance testing and inspection services for retail fuel providers in the United States. Headquartered in Austin, Texas, the Company services more than 50,000 petroleum fueling and storage facilities per year, offers more than 30 compliance-related service offerings and holds 22 patents for leak detection and tank monitoring technology. Internationally, Tanknology licensees span more than 30 countries, providing services to the largest petroleum operators in the world.

Environmental & Sustainability

Software & Tech-Enabled Services

Mergers & Acquisitions

Founded in 1994, New Century is a leading provider of pipeline integrity management software and services to energy transportation companies. The Company is headquartered in Fort Collins, Colorado and provides software solutions, data management expertise, and extensive pipeline experience to enable a global network of customers in the oil and gas industry to manage pipeline integrity, meet regulatory compliance, and maximize safety and reliability.

Industrial Services & Manufacturing

Mergers & Acquisitions

Volta is a leading supplier of low and medium voltage control centers , low and medium voltage switchgear, and integrated electrical equipment centers and is supported by a team of strong engineers and technicians. Located in Houston, Texas, Volta maintains state-of-the-art fabrication capabilities which can handle significantly large projects and employs over 120 full-time employees.

$14,900,000

Business Services

Software & Tech-Enabled Services

Raising Capital

Financial Restructuring

Voice Media Group Inc. is a diversified media and marketing services company that specializes in serving advertisers, business owners and readers across the country as the digital heir to one of America’s most successful media organizations. Based in Denver, Voice Media Group today publishes four weekly alternative print newspapers with affiliated web properties and two additional digital-only platforms. The Company’s fast-growing digital marketing agency, V Digital Services (“VDS”), offers the most complete range of digital marketing services available targeting small and medium businesses, including organic and local search engine optimization, paid media placement, programmatic display advertising and social media management, among others.

Priest Equities, LLC

Consumer Products & Services

Mergers & Acquisitions

Raising Capital

Based in Grapevine, Texas, Amtel is a leading T-Mobile Premium Retailer (TPR) with 152 locations across multiple U.S. geographies, including Texas, California, Indiana, Ohio, Kentucky, New York and Massachusetts. Amtel is led by long-tenured wireless retail industry veterans who manage a team of highly talented, store-level employees that deliver world-class customer service and leading T-Mobile system operational performance.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

Bright is the dominant North American formulator and contract manufacturer of hair bleach and depilatory powders for leading global beauty brands, with a long-standing reputation for product quality, consistency and extraordinary customer service levels.

Industrial Services & Manufacturing

Mergers & Acquisitions

Trantech is a designer, manufacturer and supplier of radiators and other cooling systems for transformers used in the generation, transmission and distribution of electric power. The Company’s products are sold to transformer original equipment manufacturers as well as utility and industrial aftermarket customers for repair and replacement applications.

Industrial Services & Manufacturing

Mergers & Acquisitions

Trinity Steel is a leading provider of structural steel fabrication services to the petrochemical, energy, diversified chemical, power, commercial construction and engineering industries. Headquartered in Trinity, Texas, the Company is one of the largest fabricators in the Gulf Coast region. The Company’s fabrication services include the cutting, drilling, welding, punching, burning and shearing of structural steel beams and plates.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Founded in 1979 and headquartered in Seattle, Global is an international leader in the marine services industry with decades of experience managing complex, critical, and technical projects in and around the water. Operating in some of the most challenging environments, the Company’s skilled and seasoned professionals offer clients five core services: marine construction, casualty response, environmental services, commercial diving, and energy services. The Company has six locations in the western U.S. and serves clients both domestically and abroad. Global will continue to operate under its current brand as a wholly-owned subsidiary of MER.

Business Services

Software & Tech-Enabled Services

Mergers & Acquisitions

SchoolAdmin is a market leader in admissions, enrollment and billing technology for K-12 schools. Working closely with over 400 customers, the Company has gained a deep understanding of the needs of parents and school administrators. SchoolAdmin is driven by a mission to improve a school’s ability to recruit, admit, enroll, and retain students through easy-to-use, feature-rich solutions.

Energy, Power & Infrastructure

Mergers & Acquisitions

Calculated Controls provides project control solutions and project management personnel to owners of industrial facilities, such as refineries and petrochemical plants, to assist in managing turnarounds and other major projects. The Company’s trained professionals include project controls managers, field planners, schedulers, cost engineers and similar professionals. Calculated Controls offers these resources on a temporary, as-needed basis.

Specialty Distribution

Mergers & Acquisitions

Founded in 1999 and based in Houston, Texas, MSI Supply is a leading distributor of pipes, valves, fittings, gaskets and fasteners to industrial customers across the Gulf Coast. The Company primarily focuses on sourcing materials for emergency situations and ongoing routine maintenance. MSI Supply offers more than 50,000 SKUs and utilizes its proprietary bidding software, which enables it to quote immediately upon request, and delivery often occurs within hours.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 2014 and headquartered in Indianapolis, SupplyKick is a leading eCommerce retailer, working directly with more than 50 brands to manage and optimize sales on Amazon as well as other eCommerce sites such as eBay and Walmart.com. The Company utilizes advanced technology and strategies to expand its partner’s online sales by managing marketing, advertising, logistics and compliance for its manufacturing partners.

Consumer Products & Services

Mergers & Acquisitions

Headquartered in Baton Rouge, LA, Louisiana Fish Fry provides a broad array of Louisiana-inspired food products, including spices and seasonings, seafood boils, breadings and batters, sauces and marinades, and rice mixes. The Company serves leading grocery and mass market retailers as well as foodservice customers nationwide. Founded by the Pizzolato family more than 30 years ago, Louisiana Fish Fry has earned an exceptional reputation for great tasting, authentic products, and outstanding customer service. Tony’s Seafood will continue to be 100% owned and independently operated by the Pizzolato family.

United Restaurant Holdings, LLC

Consumer Products & Services

Mergers & Acquisitions

Established in 1982 and headquartered in Minneapolis, MN, Buffalo Wild Wings, Inc. is firmly established as the dominant sports-themed dining chain in the U.S. The BWW Houston Partners, Ltd. entities were comprised of stores located in the greater Houston metro market: Sugar Land, Copperfield, Hedwig Village, The Woodlands and Atascocita. Prior to the acquisition, BWW Houston Partners, Ltd. was managed by Stephen Chappelear and Clifford Sadowsky, two of the longest tenured franchisees in the BWW system.

Industrial Services & Manufacturing

Mergers & Acquisitions

Founded in 1991, Patriot is a leading steel fabrication and erection company that provides turnkey structural and specialty steel services for commercial, industrial and municipal end markets. Headquartered in Dripping Springs, Texas, the Company has established a blue-chip customer base consisting of the largest commercial development and construction companies. Patriot primarily serves Texas but has completed projects in more than 10 states. It is one of two companies in Texas that is certified by the American Institute of Steel Construction to both construct and erect steel structures.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Raising Capital

Renegade Holding Company, LLC (dba Renegade Well Services and Renegade Automation, collectively “Renegade” or the “Company”) is a leading provider of recurring wellhead production and infrastructure services, operations and maintenance employment services, and automation services to blue-chip oil and natural gas producers. The Company operates in the nation’s most established oil and natural gas fields including the Eagle Ford, Permian, Barnett, Bakken, DJ, Utica, and Mid-Continent basins. Renegade provides essential above-ground maintenance services for oil and natural gas well-sites, as well as the associated production gathering facilities and pipeline infrastructure. The Company was founded in 2006 and is headquartered in Granbury, Texas, with additional field operations in Dilley, Godley, Odessa, and San Angelo, Texas as well as Canton, Ohio, and Hobbs, New Mexico.

Industrial Services & Manufacturing

Mergers & Acquisitions

Frontier Terminal is a 245 acre property located near Tulsa and the Port of Muskogee with over 4,300 feet of frontage on the McClellan-Kerr Arkansas River Navigation System. The property consists of a 348,000 barrel liquid asphalt blending, storage and distribution facility, a barge dock terminal and transloading facility with BNSF mainline rail running through the property. At the time of the sale, nearly 200 acres of the property remained available for further development.

Energy, Power & Infrastructure

Environmental & Sustainability

Mergers & Acquisitions

Perennial, a provider of environmental consulting and inspection services, specializes in the preparation of environmental documents that comply with the National Environmental Policy Act (NEPA) and other federal, state, and local environmental laws and regulations. The Company’s capabilities include complete surveys and evaluations for biological and physical resources, cultural resources, and other environmental studies and inspections essential to ensuring environmental compliance. Perennial’s team of biologists, scientists, toxicologists, and environmental professionals provides technical environmental solutions and management with fresh perspectives and unparalleled efficiency.

Consumer Products & Services

Mergers & Acquisitions

EOS is a recognized industry leader in the production of high-quality nutritional supplement and OTC products. The company provides turnkey outsourced manufacturing and a broad range of laboratory support services to several of the most-recognized brands in the nutritional supplement and OTC product industries. EOS formulates and produces a wide range of supplement products that include probiotics, organics, specialty formulations, vitamins, minerals, botanicals and homeopathic OTC drugs. The company specializes in complex solid-dose delivery forms, principally tablets and capsules, with flexible bottling and packaging capabilities to meet a wide range of customer requirements.

Energy, Power & Infrastructure

Specialty Distribution

Mergers & Acquisitions

Founded in 2005, PitStop is a leading distributor of heating oil, propane, kerosene and motor fuels serving retail and commercial customers throughout Southern Maine. The fastest growing portion of its fuel distribution business is its propane delivery segment, driven largely by the continued customer trend of converting from heating oil to propane. The Company delivers its services using its modern truck fleet and its network of bulk fuel terminals strategically-located throughout the Maine Lakes Region. The cold temperatures, high number of degree days and a lack of pipeline infrastructure make this one of the most attractive route-based heating oil and propane delivery markets in the country.

Paragon Southwest Medical Waste

Environmental & Sustainability

Business Services

Healthcare

Mergers & Acquisitions

Buy-Side Advisory

Paragon Southwest Medical Waste (PSMW) was formed through a joint venture agreement between Paragon Waste Solutions (PWS) and Gulfwest Waste Solutions (GWS) combined with an equity investment from an investment group. PSMW’s permitted medical waste facility in Texas uses Paragon’s patented CoronaLux™ system. This system employs a low-energy, plasma-enhanced pyrolytic process to safely and reliably destroy hazardous, chemical, biological, pharmaceutical and regulated medical waste. The CoronaLux™ system significantly reduces harmful emissions associated with high-temperature thermal processes such as incineration and conventional hot plasma incineration. The result is a more efficient and sustainable destruction process, which is much cleaner, safer and environmentally friendly.

Energy, Power & Infrastructure

Mergers & Acquisitions

Founded in Midland, Texas in 2004, Peregrine Pipeline Company, L.P. is a full service natural gas pipeline company specializing in midstream operations. Peregrine provides gathering and transportation of natural gas as well as compression, dehydration and marketing services.

Energy, Power & Infrastructure

Environmental & Sustainability

Software & Tech-Enabled Services

Mergers & Acquisitions

GeoFields is a leading global supplier of software and services for pipeline integrity data collection, management and risk analysis for the oil and gas industry. GeoFields’ software enables pipeline operators to collect critical integrity data, perform risk modeling and high consequence area (HCA) risk analysis, and prioritize pipeline integrity-related maintenance and asset management activities. The Company is headquartered in Atlanta, with offices in Houston and Denver.

Software & Tech-Enabled Services

Healthcare

Mergers & Acquisitions

Tango Health is a leading software and services company focused on supporting organizations to deliver a better benefits experience since 2008. Tango Health’s flexible solutions include decision support, benefits engagement, benefits communications, virtual open enrollment, and full-service ACA compliance and reporting.

Energy, Power & Infrastructure

Mergers & Acquisitions

JAG Energy Holdings is a Texas LLC that manufactures Automatic Custody Transfer (“ACT” or “LACT” when at the lease level) units and provides meter proving, vacuum, and other midstream related services. JAG Energy Holdings LLC owns 100% of JAG Energy USA Midstream, JAG Tanking of Texas, and Mission Measurements.

Consumer Products & Services

Mergers & Acquisitions

Founded in 2008, BL Development Group is a multi-unit franchisee of Bar Louie in the Michigan, Tennessee, Alabama and Florida markets, and is majority-owned and managed by Anthony Marougi and Zubin Antia, successful entrepreneurs with significant restaurant operating experience.

Consumer Products & Services

Mergers & Acquisitions

Buy-Side Advisory

The La Costeña Group is a global packaged foods leader whose operating companies include La Costeña (La Costeña-branded products), Sabormex (Clemente Jacques, Oro and Café Garat), Faribault Foods and Vilore Foods, amongst others. The La Costeña Group conducts business in over 30 countries world-wide and has a significant presence in the United States with manufacturing and distribution operations in Laredo, TX, Faribault, MN, and Tucson, AZ.

Energy, Power & Infrastructure

Specialty Distribution

Mergers & Acquisitions

Founded in 1980, GB Tubulars is a leading distributor of Oil Country Tubular Goods and a provider of proprietary specialty connections. The Company’s key customers are major and large independent exploration and production companies and other tubular good distributors in the Gulf of Mexico. GBT’s tubular goods and proprietary specialty connections are used in all types of drilling operations with increasing use in U.S. land-based shale plays.

Business Services

Raising Capital

Hamilton Captive Management specializes in bringing captive insurance solutions to private companies, high-net worth individuals, and families. Hamilton Captive Management prides itself on its client-centered and customized approach to its growing base of clients.

United Cellular

Consumer Products & Services

Mergers & Acquisitions

Buy-Side Advisory

Connectivity Source was founded in 1999 and is a leading retailer of wireless communication services, equipment, and related accessories for Sprint. From its founding, Connectivity has grown to become one of the largest Sprint Preferred Retailers in the country by overall system store count. The Company currently operates 146 locations across Arkansas, Arizona, Louisiana, North Carolina, Oklahoma, South Carolina and Texas.

Consumer Products & Services

Raising Capital

Connectivity Source was founded in 1999 and is a leading retailer of wireless communication services, equipment, and related accessories for Sprint. From its founding, Connectivity has grown to become one of the largest Sprint Preferred Retailers in the country by overall system store count. The Company currently operates 146 locations across Arkansas, Arizona, Louisiana, North Carolina, Oklahoma, South Carolina and Texas.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Sand Products Wisconsin operates a frac sand mine with mineral rights to more than 50 million tons of Northern White sand reserves across 1,100 acres in western Wisconsin. SPW’s wet and dry sand processing plants and unit train load-out facilities have an annual capacity of up to 1.4 million tons.

Strox Systems

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Screen Logix, a subsidiary of AXON Pressure Products, is a leading provider of aftermarket shale shaker screens used in the drilling of oil and gas wells. Shale shakers are part of the drilling fluid filtration system employed on rigs to remove solids from fluids as they return to the surface and are processed for re-use or disposal. The company manufactures replacement screens for nearly every make and model of shale shaker, and supplies manufacturers of solid control systems with private label screens.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

Faribault’s beverage division is comprised of a state-of-the-art, SQF Level III-certified manufacturing plant in Elk River, MN, approximately 40 miles northwest of Minneapolis. Constructed in 2001, the plant serves as the leading private label supplier and contract manufacturer of pouch products to leading beverage brands. Its customer base includes Sunny Delight, Juicy Juice and Back to Nature, among others, which sell to a blue-chip group of grocery retailers, wholesalers and supercenters.

Business Services

Software & Tech-Enabled Services

Mergers & Acquisitions

Founded in 2008, Utegration is a leading full service SAP consulting and implementation company serving the utility and energy industries. The company has built a strong reputation in the utility industry and today serves many of North America’s leading electric, gas, and water utilities with proven capabilities to enhance utility customer satisfaction, achieve regulatory mandates for service improvements, provide valuable business intelligence solutions to better manage enterprise assets, and help utilities address the digital transformation of the power grid. Utegration’s deep technical and utility sector expertise has positioned Utegration as a thought leader in the industry, as reflected by its recent recognition by SAP as Partner of the Year for the Utility Industry.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Alternative Well Intervention was founded by veterans of the well servicing industry in December 2012 to design, build and operate a best-in-class HWU optimized for offshore use in the GOM.

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

MeriCal is a recognized industry leader in the production and packaging of high‐quality nutritional supplement products. Founded in 1965, the company provides value‐added contract manufacturing and custom bottling and packaging services, along with a broad range of laboratory support services to several of the most recognized retailers and nutritional supplement brands in the industry.

Its Founding Management Team

Consumer Products & Services

Industrial Services & Manufacturing

Mergers & Acquisitions

BOTE was founded in Destin, FL by Corey and Magda Cooper, with a singular mission: “Stand Apart through industry-shaping innovation, fresh ideas and simplicity to create a product that defines a lifestyle.” With that mindset, BOTE has rapidly emerged as one of the most prominent brands in the active outdoor lifestyle market by designing products that deliver step function improvements in functionality and ease-of-use, and that have design aesthetics that run away from the competition.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Alternative Well Intervention was founded by veterans of the well servicing industry in December 2012 to design, build and operate a best-in-class HWU optimized for offshore use in the GOM.

Energy, Power & Infrastructure

Raising Capital

MML Capital Partners is a leading transatlantic independent investment firm with over $2 billion invested in more than 100 platform businesses since 1988. MML backs leading management teams in companies that require capital for expansion, acquisitions, refinancing or recapitalizations. MML brings international resources and perspective to each market it serves through its investment teams in the UK, France and United States.

Business Services

Software & Tech-Enabled Services

Raising Capital

Headquartered in Austin, Texas, BP3 Global, Inc. (BP3) is the leading provider of business process and decision management (BPM) software and services, providing business process, decision management, and analytics software and services to the Fortune 500. Since 2007, BP3’s Brazos Platform has been powering thousands of digital transformations for their customers. BP3’s solutions and services have transformed customer experiences in financial services, retail, healthcare, and the energy sectors. BP3 goes beyond analytics by embedding insights into workflows to actually address the problems by connecting the dots between the customer experience and the enterprise. The largest corporations in the world depend on BP3’s operational services including: 24×7 solution support, process optimization, migration assistance, and cloud management.

Energy, Power & Infrastructure

Mergers & Acquisitions

Headquartered in Inola, Oklahoma, ParFab, which is comprised of ParFab Industries, LLC and ParFab Field Services, LLC, is a provider of components and field services for heat and pressure intensive applications related to the downstream energy infrastructure markets. ParFab focuses on steel fabrication, ASME coil welding, piping, refractory and industrial coatings services from its fabrication facility, and its field services division focuses on process heater erection, revamp / re-tubing, and other activities stemming from the downstream new capital and recurring maintenance cycles.

Energy, Power & Infrastructure

Specialty Distribution

Mergers & Acquisitions

Based in Midland County, TX, Cactus Fuel is a leading provider of specialized fuel services to operators and drillers in remote locations in the Permian basin. Cactus Fuel was founded in 2012 by a management team with extensive oilfield service experience.

Environmental & Sustainability

Business Services

Mergers & Acquisitions

SouthWaste Services Holdings, LLC. and its subsidiaries (collectively “SouthWaste” or the “Company”) is a leading, vertically-integrated environmental services firm providing non-hazardous liquid waste collection, processing, and disposal services across the southern U.S. SouthWaste provides grease trap (i.e., brown grease) and commercial septic waste collection, cleaning, and maintenance services for over 4,600 customers which include restaurants, grocery stores, prisons, stadiums, hospital systems, and school districts. The Company’s five permitted processing and disposal facilities (Houston, Dallas, San Antonio, Lubbock, and Orlando) process over 91 million gallons of waste annually.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Raising Capital

Founded in 2000, Gibson Applied Technology & Engineering, Inc. (GATE) is a privately held consulting and engineering firm based in Houston, Texas that serves clients in the deepwater offshore oil and gas industry. GATE was established as a consultancy specializing in the areas of materials selection and corrosion control, subsequently expanding its capabilities to include flow assurance, commissioning & startup, water injection systems design, subsea engineering, operations readiness, chemical systems engineering and regulatory compliance.

Energy, Power & Infrastructure

Software & Tech-Enabled Services

Buy-Side Advisory

RigNet is a leading global provider of managed remote communications, telecoms systems integration and collaborative applications dedicated to the oil and gas industry, focusing on offshore and onshore drilling rigs, energy production facilities and energy maritime vessels. RigNet provides solutions ranging from fully-managed voice and data networks to more advanced applications that include video conferencing and real-time data services to over 1,100 remote sites in fifty countries on six continents, effectively spanning the drilling and production industry. RigNet is based in Houston, Texas.

Financial Advisory Services

Industrial Services & Manufacturing

Advisory Services

Tideland is a leading provider of marine aids-to-navigation (“AtoN”) systems worldwide. With offices located in the United States, Canada, Singapore, United Arab Emirates, China and the United Kingdom, the Company is one of the world’s largest providers of a full suite of AtoN products and services including lanterns, buoys, radio aids, audible aids and related installation and repair services. Founded in 1954, Tideland serves an internationally diverse customer base consisting of several thousand ports, national lighthouse authorities, coast guards and public and private corporations.

Industrial Services & Manufacturing

Mergers & Acquisitions

Headquartered in Houston, Texas, with key locations in The Netherlands, the United Kingdom, Dubai, Germany and Singapore, Tideland is a leading producer of aids to marine navigation, sold under the Tideland and IMT brands. With navigation products and services used by, ports and harbors, marine authorities, offshore oil and gas, wind farms and military installations.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Alternative Well Intervention was founded by veterans of the well servicing industry in December 2012 to design, build and operate a best-in-class HWU optimized for offshore use in the GOM.

Specialty Distribution

Mergers & Acquisitions

XL Parts is the largest direct-to-the-installer automotive parts supplier in the Houston, Dallas/Fort Worth, Oklahoma City, and Baton Rouge metropolitan areas with over 67 stores. XL Parts stocks over 120,000 different part numbers, covering 175 product lines from multiple manufacturers, and is able to deliver orders to its installer customers in less than 45 minutes utilizing its differentiated distribution model. The company, founded by Ali Attayi in 2001, is headquartered in Houston, Texas.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Infinity is a leading U.S. industrial construction and maintenance contractor with in-house fabrication facilities providing services to the refining, petrochemical and gas processing industries. A family-owned business established in 1952, Infinity is headquartered in Clute, Texas, with six additional locations along the Texas Gulf Coast. The existing management team will continue to lead the business, which has approximately 2,500 personnel. Infinity currently has gross assets of around $92 million and is forecast to generate EBITA of $26 million in 2015.

Consumer Products & Services

Mergers & Acquisitions

Cross-Border Transactions

ABL Management is a Baton Rouge, LA based provider of dining services to the Correctional market, and its subsidiary, ABL Educational Enterprise, provides foodservice to the Higher Education markets.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions

T&T Engineering is a leading provider of proprietary products and engineering services to the energy industry. Products include state-of-the-art drilling structures and drilling equipment that deliver superior operational safety, reductions in non-productive work, greater reliability and improved interface with other rig equipment and operations.

Consumer Products & Services

Mergers & Acquisitions

Buy-Side Advisory

Cross-Border Transactions

Sinomax USA, headquartered in Houston, Texas, has emerged as a world-class designer, manufacturer and marketer of soft-home bedding, including memory foam sleep products. Its product lines include mattress toppers, pillows and mattresses, as well as soft-home furniture.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Buy-Side Advisory

Headquartered in Houston, T-Rex is a leading fabricator of complex subsea equipment packages for use in the offshore oil and gas production industry. Its products include custom designed subsea production modules for managing the flow of oil and gas from offshore wells. T-Rex’s projects are deployed globally across the Gulf of Mexico, West Africa, Central and South America, and the North Sea.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Rocaceia is a leading provider of oilfield accommodations and related equipment and services to drilling rig operators and well completion companies in the Eagle Ford shale formation of south Texas. The company leases these assets to clients under the Quality Lease Service, LLC (“QLS”) and Quality Lease Rental Service, LLC (“QLRS”) names.

Business Services

Software & Tech-Enabled Services

Mergers & Acquisitions

Internet America (OTC: GEEK) is a leading wireless Internet service provider (“WISP”) focused on providing high-speed broadband Internet and related services to subscribers in areas not covered by traditional Internet service providers. The Company is headquartered in Houston, Texas and offers a product suite that includes wireless Internet, specialized e-mail, DSL Internet, dial-up Internet, Internet fax, and other various ancillary products totaling approximately 27,000 subscriber services in Texas, Missouri and Oklahoma.

Financial Advisory Services

Business Services

Software & Tech-Enabled Services

Advisory Services

Internet America (OTC: GEEK) is a leading wireless Internet service provider (“WISP”) focused on providing high-speed broadband Internet and related services to subscribers in areas not covered by traditional Internet service providers. The Company is headquartered in Houston, Texas and offers a product suite that includes wireless Internet, specialized e-mail, DSL Internet, dial-up Internet, Internet fax, and other various ancillary products totaling approximately 27,000 subscriber services in Texas, Missouri and Oklahoma.

Energy, Power & Infrastructure

Industrial Services & Manufacturing

Mergers & Acquisitions

Cross-Border Transactions